Since the COVID-19 pandemic began, telehealth has been a key factor in treating behavioral health issues. In 2021, more than 30% of surveyed adults reported symptoms of anxiety and depression, up from 11% in 2019. Part of meeting the demand for behavioral health services during the pandemic included leaning increasingly on telehealth services, a key mechanism for delivering behavioral healthcare without increasing risk of exposure to COVID-19.

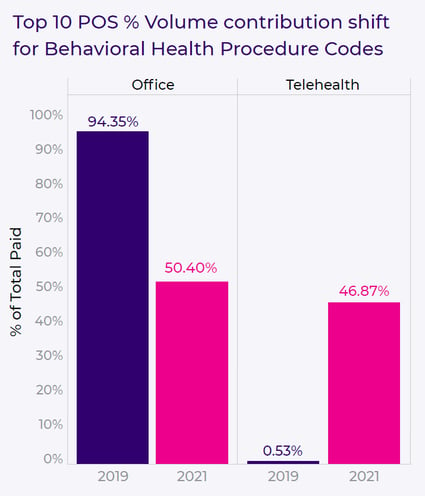

In fact, according to Cotiviti’s own data, the volume contribution for behavioral health procedure codes in telehealth shifted from 0.53% in 2019 to 46.87% in 2021 (Figure 1).

Figure 1. Changes in office visits vs. telehealth from 2019 to 2021.

Figure 1. Changes in office visits vs. telehealth from 2019 to 2021.

Another component of meeting the demand for behavioral health services was to change regulatory requirements to allow easier access to telehealth. This included relaxing restrictions on video protocols for increased accessibility, as well as flexibility in delivering behavioral health services across state lines, and other changes.

But while all intentions have been to increase access to care, this scenario of increased demand for behavioral health services, reliance on telehealth, and increased flexibility has created a perfect storm for bad actors to leverage their schemes. These bad actors have seen this situation as an opportunity for fraud, waste, and abuse (FWA).

Common, detected schemes include:

Billing for individual vs. group therapy

One scheme revolves around fraudulent reimbursement—billing plans for individual therapy when they should be billed for group therapy. Cotiviti’s own data found a specific case where 57% of one provider’s encounters included billing for individual psychotherapy visits for multiple members of the same household. After a record review, Cotiviti experts confirmed that the 60-minute individual therapy sessions should have been billed as group therapy, resulting in overpayments to this provider totaling >$500K.

Impossible days

Another example involves hours paid vs. dates of service. Cotiviti recently found one provider to be coding over 96% of their claims as 60-minute psychotherapy—and compared to peers that percentage was a significant outlier. When analysis was performed for dates of services (DOS) vs. unique patients vs. the total hours spent for each session, there was a significant discrepancy: The provider billed for 26 hours of service and eight patients per DOS on average, known as “impossible days,” and billed for more than 24 hours for a total of 122 separate DOS.

Creative upcoding

An additional FWA scenario in individual psychotherapy includes “creative upcoding.” Say that a provider bills a 60-minute psychotherapy service with an added Evaluation and Management (E&M) code, which typically denotes an office visit. In this scenario, for the coding to be accurate, the provider would need to provide a “medical service” for the E&M code and a “psychotherapy service” for the PST code. But the likelihood of this combination occurring would be highly unusual.

Learn more about these kinds of schemes—and how your organization can protect itself—in our latest white paper, Rising telehealth: Catching FWA in behavioral health claims. We explore FWA within behavioral health claims and the recent conditions that have created opportunities for bad actors.

Read the white paper as we:

- Examine how and why weak points exist within behavioral healthcare claim payments

- Walk through FWA schemes related to behavioral claims delivered via telehealth

- Explain how plans can both safeguard themselves and be confident in their own claim accuracy